InPost Group Q1 2025 results

27 May 2025

Profitability uplift and market share gains across key geographies InPost Group, Europe's leading e-commerce logistics enabler, reports a set of strong first quarter financial results and accelerated expansion of its out-of-home delivery network.

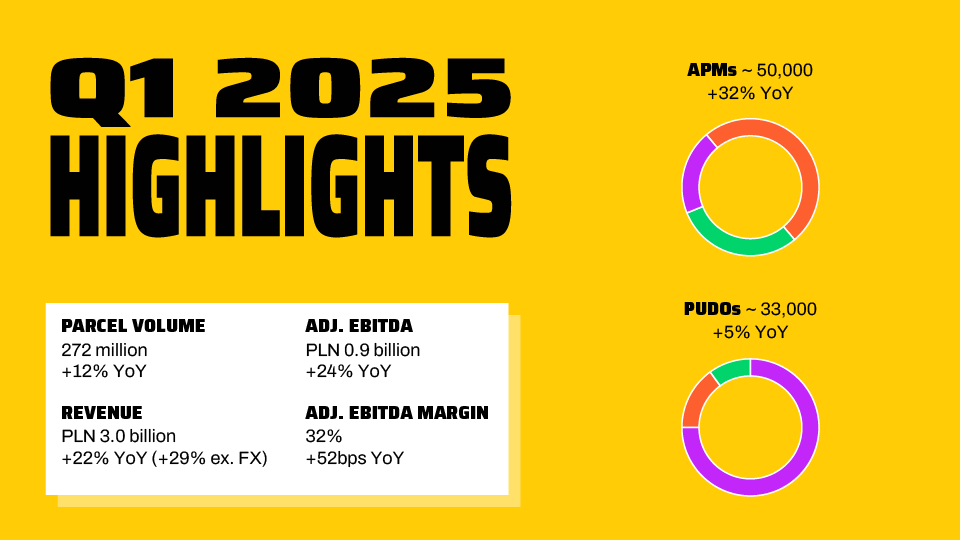

Executive summary Q1 2025

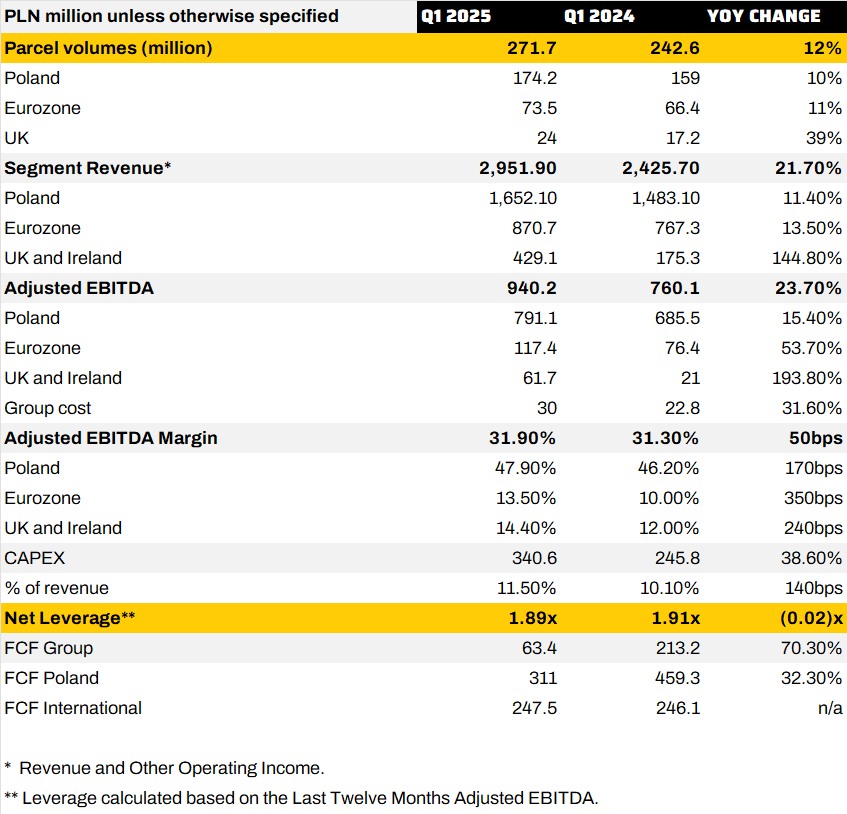

• Volume growth outpacing the market: InPost Group's parcel volume reached 272 million, a 12% year-over-year (YoY) increase, outperforming e-commerce market growth in its key geographies. The UK segment led with a 39% YoY volume increase, followed by the Eurozone at 11% YoY (with B2C growing at 29% YoY), and Poland at 10% YoY.

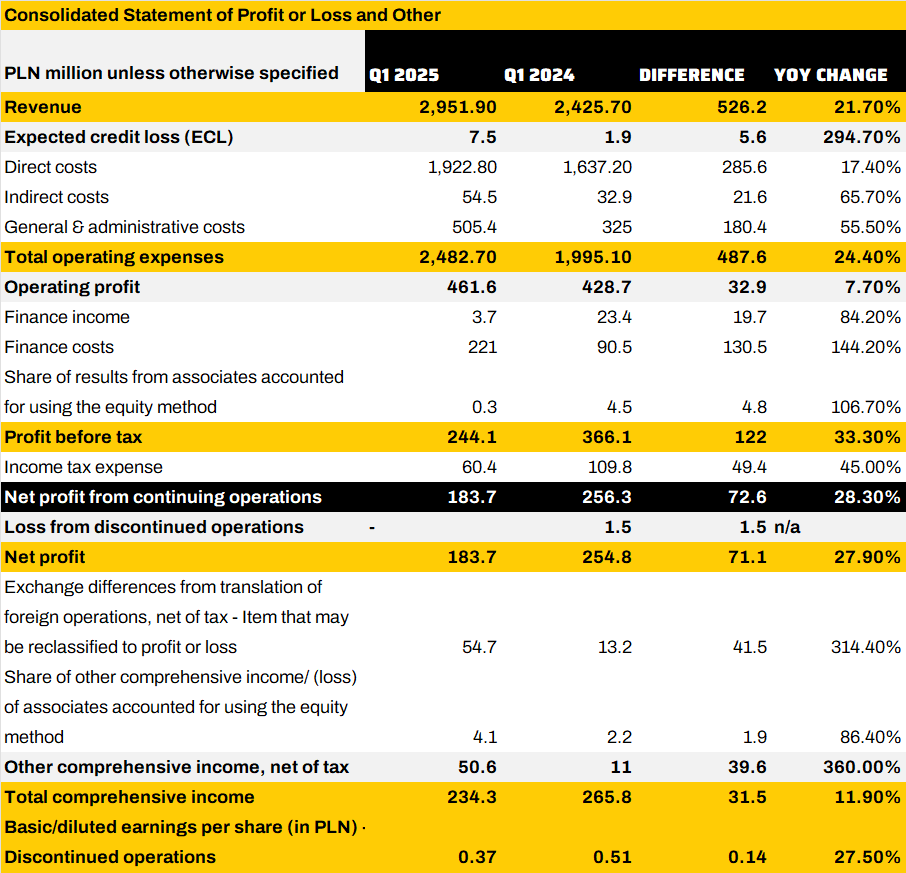

• Double-digit Group revenue growth: The Group started 2025 with significant revenue growth, achieving PLN 2,951.9 million, a 21.7% YoY improvement. This was driven by particularly strong performance in the UK & Ireland, with a 145% YoY increase, while Poland and the Eurozone saw growth rates of 11% and 14% YoY, respectively.

• Significant Adjusted EBITDA increase: Group Adjusted EBITDA reached PLN 940.2 million in Q1 2025, reflecting a 23.7% YoY increase. The Adjusted EBITDA margin increased to 31.9%, marking a 52bps improvement compared to Q1 2024. This was primarily driven by Poland, supported by margin improvements in both the Eurozone and the UK & Ireland segment.

• Financial discipline with net leverage at 1.9x: InPost achieved positive free cash flow of PLN 63.4 million, impacted by full-year income tax balance payments made in Q1 2025 (whilst paid last year in Q2 2024). Net leverage remained at 1.9x consistent with the end of 2024 despite the impact of the cash injection into Yodel incurred in Q1 2025.

• Network expansion: In Q1 2025, Capex amounted to PLN 340.6 million, with nearly 70% allocated to network development, in line with our strategy to strengthen our position as the leading locker network in Europe. This investment allowed us to achieve the milestone of 50,000 APMs.

• Poland's volume exceeds market growth: Volume in Poland increased by 10% YoY, exceeding e-commerce market growth. SME merchants were the primary driver, with 18% YoY growth. The Adjusted EBITDA margin increased to 47.9% in Q1 2025, supported by changing volume structure and effective cost control.

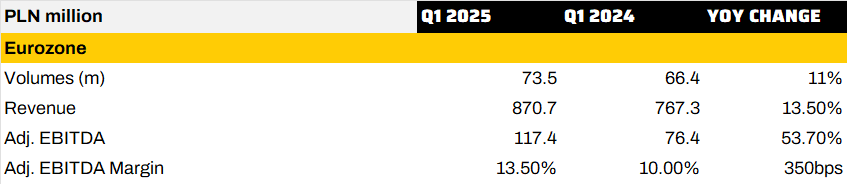

• Eurozone B2C expansion and profitability improvement: Eurozone parcel volume reached 73.5 million, an 11% YoY increase. Revenue grew by 13.5% YoY (17% in local currency, EUR), with Adjusted EBITDA margin increasing to 13.5% compared to 10.0% a year earlier. This growth was driven by higher volume, increasing APM adoption and operational leverage.

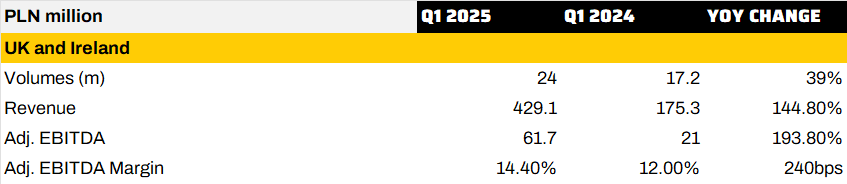

• High dynamic growth in the UK across all levels: In the UK and Ireland, InPost delivered 24.0 million parcels in Q1 2025 (a 39% YoY increase), while revenue increased by 144.8%. Adjusted EBITDA tripled, and margins improved due to efficiency gains and the consolidation of Menzies. In April, InPost acquired Yodel, which will be consolidated starting from May 2025.

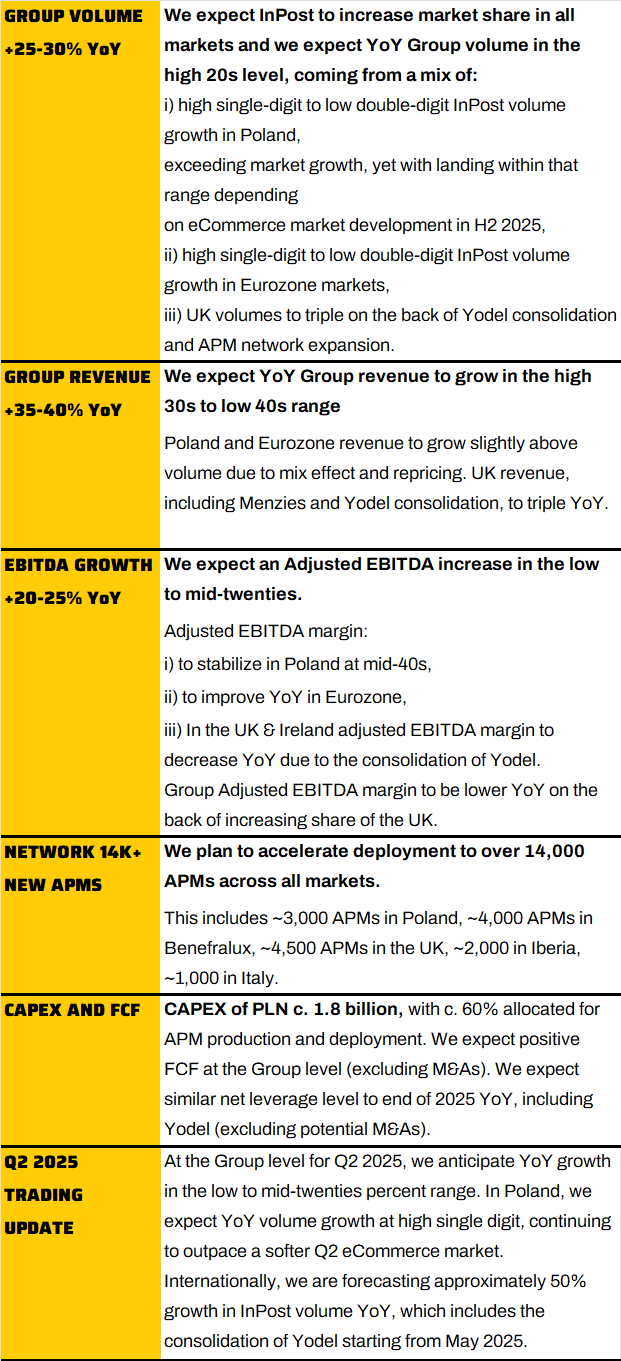

• Trading update Q2: At the Group level for Q2 2025, we anticipate YoY growth in the low to mid-twenties percent range. In Poland, we expect YoY volume growth at high single digit, continuing to outpace a softer Q2 eCommerce market. Internationally, we are forecasting approximately 50% growth in InPost volume YoY, which includes the consolidation of Yodel starting from May 2025. Rafał Brzoska, Founder and CEO of InPost Group, commented: " InPost Group made a strong start to 2025, in line with our expectations. Our Group parcel volume increased by 12%, surpassing market growth across key geographies. Key contributors to this volume increase include the SME sector in Poland and the B2C segment in the Eurozone. In the UK, the impact of B2C offer expansion is already visible in our volume, and this will become even clearer going forward, thanks to the acquisition of Yodel finalized last month.

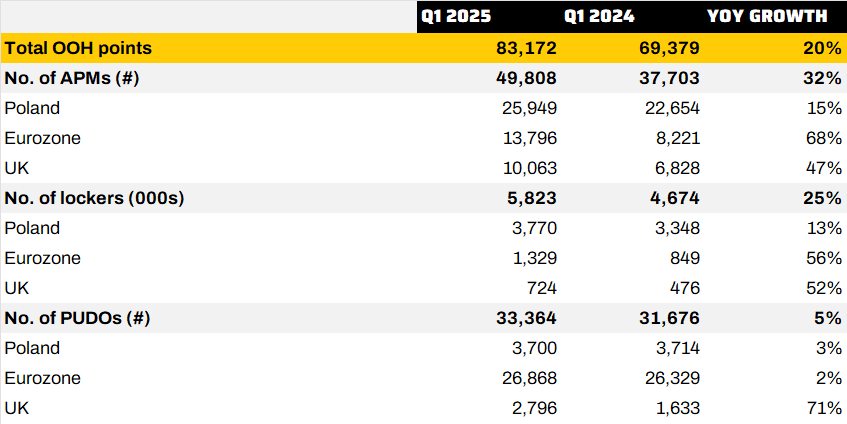

We are proud to be the leading pan-European locker network and we are continuing our rapid expansion. In Q1, we deployed almost 3,000 lockers, bringing our APM network to a milestone of 50,000 machines. We remain focused on international expansion. In April, we acquired Yodel, a major logistics player in the UK. This transaction elevates us to the position of the third-largest agnostic logistics provider in this market. We are also strengthening our relationships with merchants. This week, we launched a partnership with ASOS, offering exclusive next-day delivery to lockers and PUDO points in the UK. Recently, we announced a multiyear contract with Vinted, Europe's leading marketplace for second-hand fashion. In Poland, we have broadened our offer for Amazon, demonstrating our ability to support major marketplaces and merchants in the region. These strategic moves position us well for continued growth as we progress toward becoming the #1 e-commerce logistics provider in Europe. " Out-of-home (OOH) network by segment

Q1 2025 results by segment

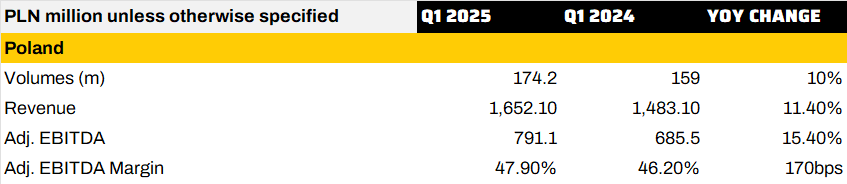

Poland: Strong results driven by volume growth and excellent cost management

In Q1 2025, our parcel volumes in Poland increased by 10% YoY, reaching 174.2 million. This growth, (achieved despite a high base from last year attributed to volumes from international marketplaces), was largely driven by a strong 18% YoY increase from SME merchants. APM volume growth rose by 10% YoY, while to-door deliveries increased by 7%. The faster growth in APM volume compared to to-door deliveries resulted from higher APM adoption among international marketplaces compared to Q1 2024.

Revenue generated in Poland in Q1 2025 reached PLN 1,652.1 million, marking an 11.4% YoY increase. Revenue growth exceeded volume growth due to low-single-digit repricing of APM deliveries, which was slightly offset by the volume mix. Adjusted EBITDA in Poland increased by 15.4% to PLN 791.1 million, with the adjusted EBITDA margin reaching 47.9%, a 170 basis point improvement. This enhanced profitability was driven by effective cost-per-parcel management, supported by a shift in volume structure towards more SMEs.

Free cash flow in Poland totalled PLN 311.0 million in Q1 2025, compared to PLN 459.3 million in Q1 2024. The decrease is primarily due to a PLN 249 million income tax payment for 2024 made in Q1 2025, which for 2023 financial year was paid in Q2 2024.

InPost continued expanding its network in Poland, reaching a total of 25,949 APMs, a 15% YoY increase. The growth in the number of lockers outpaced volume growth due to the phasing of deployments throughout the year. Relentless focus on user experience, uncompromising quality and continuous network expansion led to an increase in APM users, rising to 19.6 million by the end of Q1 2025, with over 1 million new users gained in the last 12 months.

We are strengthening relationships with existing merchants and gaining new ones; at the end of Q1 2025, we were cooperating with over 55,000 merchants. Additionally, InPost Pay accelerated its development, reaching 2,000 merchants and over 8 million registered users. Eurozone: Continuous improvement in profitability driven by B2C expansion and higher APM adoption

In Q1 2025, parcel volumes in the Eurozone reached 73.5 million, an 11% YoY increase, surpassing overall e-commerce market growth. This growth was primarily driven by the B2C segment, which saw a significant 29% increase and now accounts for 49% of total volumes. The growing B2C volumes are partly attributed to enhanced logistics quality, with 65% of B2C deliveries now arriving the next day and 94% within two days.

The Eurozone reported total revenue of PLN 870.7 million in Q1 2025, reflecting a 17% increase in local currency and a 13.5% increase in PLN. This revenue growth slightly outpaced volume growth, attributed to a favourable volume mix, particularly in cross-border and to-door deliveries. Adjusted EBITDA reached PLN 117.4 million, a substantial 58.3% YoY increase in EUR and a 53.7% increase in PLN. The strong improvement in Adjusted EBITDA margin was driven by volume growth, B2C expansion, increased APM adoption, and operational leverage, combined with effective management of cost per parcel and SG&A expenses.

In the Eurozone, we are focused on scaling operations, improving logistics quality, and enhancing network density. By the end of Q1 2025, our OOH points totalled 40,664, a 17% YoY increase. Our locker network expanded by 68%, reaching nearly 14,000 machines, solidifying our position as the leading independent APM network in the region.

Locker adoption continues to increase, with 38% of all OOH volumes now processed through APMs, compared to just 24% a year ago. Our customer base is expanding rapidly, with a 64% YoY increase in APM users. App downloads reached 4.2 million by the end of Q1 2025. We plan to launch the InPost mobile app in two additional Eurozone markets this year.

InPost's Eurozone cross-border parcels already comprise 20% of the region's total volumes, and our market share of cross-border volume within Eurozone markets is approximately 7- 9%. Our next strategic steps include unifying the user experience, expanding adoption among international merchants, further enhancing logistics capabilities, and integrating the UK into our cross-border offerings.

The UK & Ireland segment encompasses InPost's e-commerce parcel delivery operations, primarily facilitated through an extensive OOH network in the UK. InPost also distributes newspapers across the UK and Ireland through its subsidiary, Menzies Newstrade.

In Q1 2025, parcel volumes in the UK reached 24.0 million, a 39% YoY increase. This growth was mainly driven by locker-to-locker and return volumes. In the strategic B2C area, we achieved significant wins, such as our partnership with ASOS and Adanola, where InPost is prominently featured at checkout. Following the acquisition of Yodel, finalized in April 2025 (consolidated from May 2025), we now collaborate with over 700 B2C merchants.

Revenue in the UK & Ireland segment increased by 144.8% YoY, reaching PLN 429.1 million. This growth was driven by consolidation of results from Menzies, acquired in October 2024. Revenue growth excluding Menzies was lower than the volume increase due to a change in product mix, particularly a higher proportion of locker-to-locker deliveries, which is positive for margins.

Adjusted EBITDA in the UK & Ireland tripled to PLN 61.7 million in Q1 2025 due to efficiency improvements and the consolidation of Menzies results. During Q1 2025, InPost's UK APM network expanded to over 10,000 locker machines, and ended the quarter with nearly 13,000 OOH points. Including Yodel's PUDO points, we now boast over 16,000 touchpoints in the UK, solidifying InPost's position as the leading OOH network in the region. Currently, 75% of the population in the top three cities live within a 7- minute walk of an InPost OOH point, reaching over 51% of the entire UK population.

Our customer base continuous to increase , with 42% more APM users YoY, and our mobile app downloads have reached 2.0 million. Outlook FY 2025 & Q2 2025 trading update This outlook has been revised: (1) to reflect our new reporting segments, and (2) to include Yodel consolidation starting from May 2025, affecting volume, revenue and profitability.

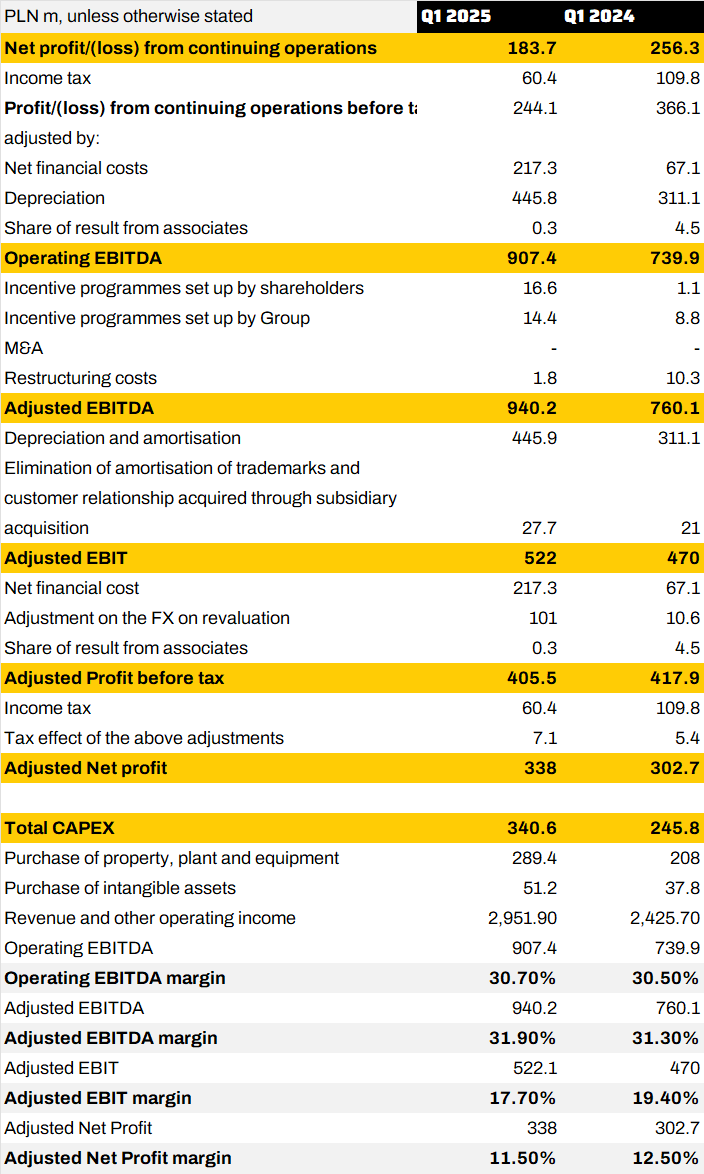

Consolidated financial information

Consolidated Statement of Financial Position

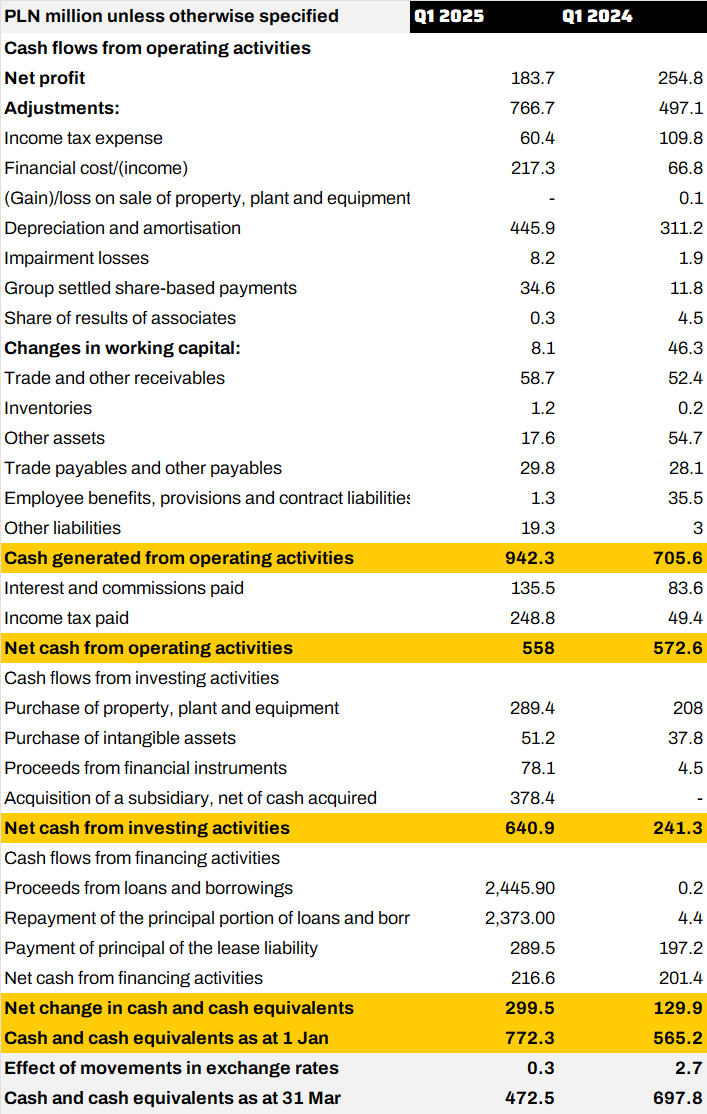

Consolidated Statement of Cash Flows

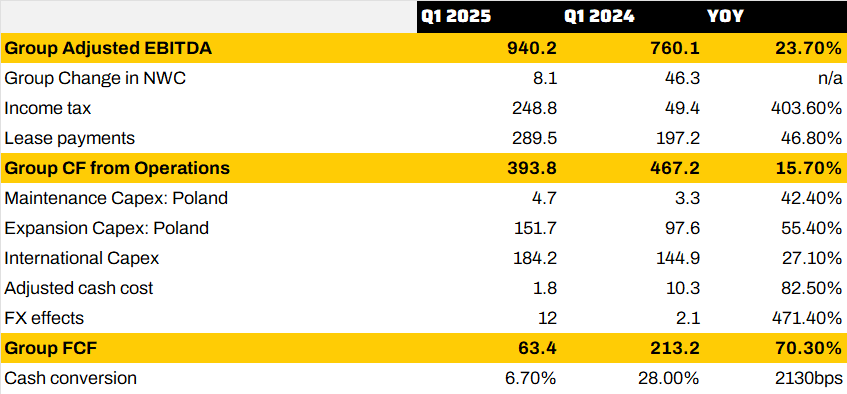

Free cash flow bridge

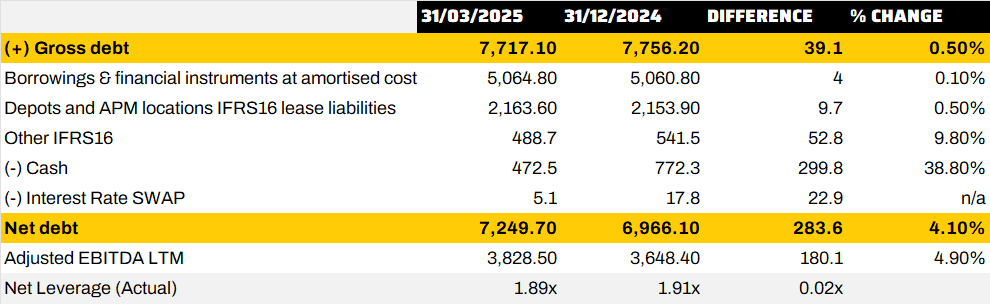

Net Debt and Leverage

Definitions and numerical reconciliations of Alternative Performance Measures InPost S.A. is the parent company of the InPost Group (“InPost”, the “Company” or the “Group”).

Operating EBITDA facilitates the comparisons of the Group’s operating results from period to period and between segments by removing the impact of, among other things, its capital structure, asset base and tax consequences. Operating EBITDA is defined as net profit for the period adjusted for profit (loss) from discontinued operations, income tax expense (benefit), profit on sales of an organised part of an enterprise, share of profits of equity-accounted investees, finance costs and income as well as depreciation and amortisation.

Adjusted EBITDA facilitates the comparison of the Group’s operating results from period to period and between segments by removing the impact of, among other things, its capital structure, asset base, and tax consequences, and one-off and non-cash costs that are not related to its day-to-day operations. Adjusted EBITDA is defined as net profit/(loss) for the period, adjusted for profit/(loss) from discontinued operations, income tax expense/(benefit), profit on sales of an organised part of an enterprise, share of result of equity-accounted investees, gain/(loss) on revaluation of previously owned shares in acquired entities, finance costs and income, depreciation and amortisation, adjusted with non-cash (share-based payments), and one-off costs (mainly Restructuring and Acquisition costs). Restructuring costs refer to the legal and advisory costs of the standardisation of operating, administration, and business processes of acquired companies to align them with Group standards. Acquisition costs refer to the legal and advisory costs connected with potential and actual acquisition projects.

Adjusted EBIT is defined as the operating profit for the period, adjusted for one-off/non-cash costs, as described in the Adjusted EBITDA definition, and adjusted by amortisation of customer relationship and trademarks acquired during the M&A process. In Management’s opinion, the elimination of amortisation of intangibles, identified during purchase price allocation, allows the costs of assets, which cannot be recreated at any point in the future of the Group, to be eliminated.

Adjusted Profit Before Tax is defined as the profit before tax, adjusted for non-cash and one-off costs, as described in the Adjusted EBITDA paragraph, and amortisation of trademarks and customer relationships acquired during the M&A process; it also includes adjustments for exchange rate differences related to debt, denominated in PLN and valued in EUR at the InPost S.A. level.

Adjusted Net Profit is defined as the net profit or loss for the period, adjusted for non-cash and one-off costs, as described in the Adjusted EBITDA paragraph, and amortisation of trademarks and customer relationships acquired during the M&A process; it also includes adjustments for exchange rate differences related to debt, denominated in PLN and valued in EUR at the InPost S.A. level, and the tax effects of these adjustments.

CAPEX is defined as the total purchase of property, plant, and equipment, and the purchase of intangible assets, as presented in the Cash Flow Statement. This measure is used to assess the total amount of cash outflows invested in the Group’s non-current assets.

Operating EBITDA Margin is defined as Operating EBITDA divided by total revenue and other operating income.

Adjusted EBITDA Margin is defined as Adjusted EBITDA divided by total revenue and other operating income.

About InPost S.A. InPost (Euronext Amsterdam: INPST) has revolutionised e-commerce parcel delivery in Poland and is now one of the leading out-of-home e-commerce enablement platforms in Europe. Founded in 1999 by Rafał Brzoska, InPost provides delivery services through our network of more than 50,000 Automated Parcel Machines (“APMs”) in nine countries across Europe as well as to-door courier and fulfilment services to e-commerce merchants. InPost’s locker machines provide consumers with a cheaper and more flexible, convenient, environmentally friendly and contactless delivery option. Contact information Gabriela Burdach, Director of Investor Relations [email protected] Wojciech Kądziołka, Spokesman [email protected] +48 725 25 09 85

Disclaimer This press release contains inside information relating to the Company within the meaning of Article 7(1) of the EUMarket Abuse Regulation This press release contains forward-looking statements. Other than the reported financial results and historical information, all the statements included in this press release, including, without limitation, those regarding our financial position, business strategy as well as management plans and objectives for future operations, are, or may be deemed to be, forward-looking statements that reflect the Company's current views with respect to future events and financial and operational performance. These forward-looking statements may be identified by the use of forward-looking terminology, including but not limited to the terms “believes”, “estimates”, “plans”, “projects”, “anticipates”, “expects”, “intends”, “may”, “will” or “should” or, in each case, their negative or other variations or comparable terminology, or by discussions of strategy, plans, objectives, goals, future events or intentions. These forwardlooking statements are based on the Company’s beliefs, assumptions and expectations regarding future events and trends that affect the Company’s future performance, taking into account all the information currently available to the Company, and are not guarantees of future performance. By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future, and the Company cannot guarantee the accuracy or completeness of forward-looking statements. A number of important factors, not all of which are known to the Company or are within the Company’s control, could cause actual results or outcomes to differ materially from those expressed in any forward-looking statement as a result of the risks and uncertainties facing the Company. Readers are cautioned not to place undue reliance on these forward-looking statements, which relay information only as of the date of this press release and are subject to change without notice. Other than as required by applicable law or the applicable rules of any exchange on which our securities may be traded, we have no intention or obligation to update forward-looking statements. The reported financial results are presented in Polish Zloty (PLN) and all values (including operational data) are rounded to the nearest million unless otherwise stated. As a consequence, rounded amounts and figures may not add up to the rounded total in all cases.